Keeping a track of your expenses helps you more than you can think. You might think that you are going to keep spending on the things whether or not you take a not. However, this is not the case. You can reduce your expenses when you are having a complete list of your records. They will help you with managing the areas that do not need much budget.

Therefore, whether you are starting your new business or you are already into the business, make sure you take bookkeeping seriously.

And if you are new to this term, do not worry. You might think that bookkeeping is something too difficult but it is not. On the other hand, this is something that has become automated. There are software tools in the market that will help you do all the work without much effort.

So let’s have a look at some of the e-commerce accounting tips.

1 – Bookkeeping software

Source: pixabay.com

The first and most important thing that you should have in your office is your bookkeeping software. You can search and surf the web for e-commerce accounting. However, the one that we would like to recommend is here linkmybooks.com.

This is the software that allows you to have a free start. In addition to this, it allows you to connect your Books to the sales channel that you are using. So whether you are using eBay, Shopify, Amazon or Etsy, you can connect your Books with that.

Likewise, you will get to enjoy many benefits from different bookkeeping software tools. They will help you with different tasks and thus, save you time and effort. Ultimately, you will have more time for other tasks and you won’t always be busy with accounts. Different software tools offer different features and options. Also, the price of the software varies with the features that you will get. If you’re looking to automate your bookkeeping tasks, accounting software can be a great solution. With a variety of features and options, accounting software can help you streamline your accounting processes, save time, and reduce errors.

2 – Monitor your Receivable Accounts

Source: pixabay.com

Who doesn’t like to get paid? Of course, everybody does. When you are running a business, you are getting paid or paying other parties in the process. You might forget who to pay because they will remind you of that. However, it is not possible to forget from whom you need to get your payment. This is because they would like to prolong the payment as far as possible.

In addition to this, some people and companies are in no position to pay you immediately. Therefore, they would like to prolong the payment time. If you are working with such a party B, you will feel difficulty retrieving the payment. The other party might become a defaulter and you definitely do not want that to happen.

So what is the solution to that?

Keep an eye on your receivable accounts. You should know when and from whom you need to get your payment.

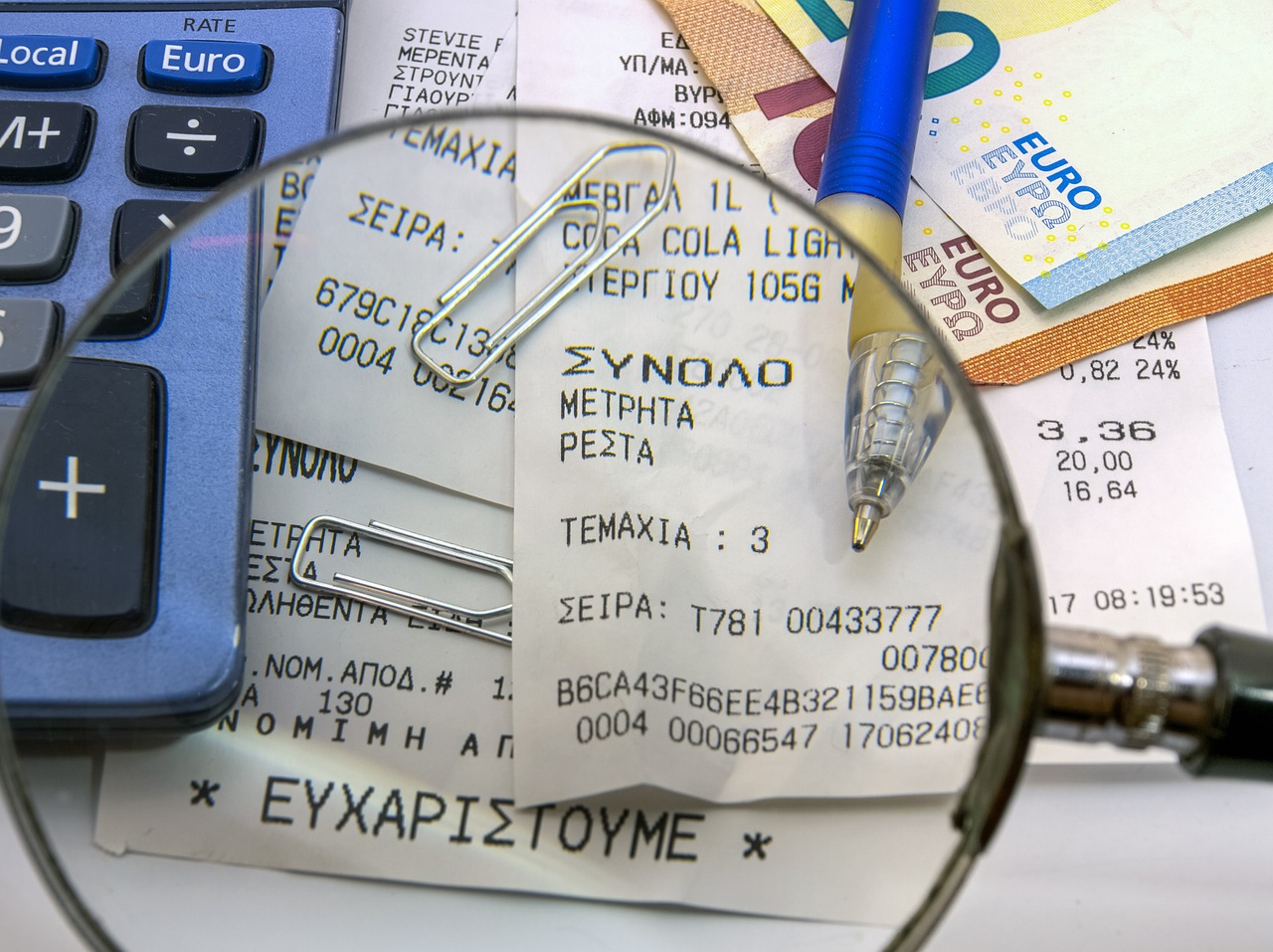

3 – Keep a record of your expense Receipts

Source: pixabay.com

You will have your bank statement. This statement tells you where you spend the amount. Thus, you can check your spending. However, would it make any difference? Most probably no.

You can only bring a change when you know where you are spending money and how much. And you can only keep a notice of that when you are keeping all the receipts safe.

Therefore, whenever you spend any money (whether it’s for personal or work-related payment) keep the receipts safe. It might seem like a hectic job but if it is saving you a lot of money, why not try doing so?

So what should you track? When you are going to save the receipts, you will surely ask this question.

And the answer is, you need to keep all the receipts safe, especially the ones for;

- Major business expenses

- Expense of traveling

- Entertainment and meals

- In case you have purchased a gift for your client

All these payments come under your business expenses. You are spending all that money on your work. Therefore, the company will pay for that. However, if you check all the receipts carefully and see how much you spent in a year or half a year, you are likely to reduce the cost of many sections.

For example, you can reduce the maximum amount of payment to be used to give a gift to a client. Likewise, you can reduce travel expenses and only allow travels that are extremely necessary. Such planning will save you a lot of money.

4 – Keep your personal and business account separate

In the case of small businesses, personal and business expenses are often merged. If there are only one or two owners of a business, they will not separate their spending. Therefore, they end up spending more money than they can and should.

Therefore, whether you are the sole owner of a business or not .you should keep two accounts. One should be for your personal use and the other one for business purposes. When you do so, you will be able to know how much you are spending on your personal items. Likewise, all your business dealings and expenses will be in one place. This will give you a better insight into things. Furthermore, you will be able to manage your expenses.

5 – Go into the details of your accounts

When you are operating a medium to big business, you will be using different accounts. So when you are using different accounts for business deals, you will need their details too. So make sure you are getting these reports from your accounts;

- Receivable accounts

- Account payables

- Your sales

- All the purchases

- Any retained earning

- Owner’s equity

- Payroll expenses

If you go into the details of these reports, you will be able to prevent any stash transactions. Thus, there won’t be any clutter and you will have a better organizational performance.